- Shopify invoicing how to#

- Shopify invoicing pro#

- Shopify invoicing code#

- Shopify invoicing professional#

Shopify invoicing professional#

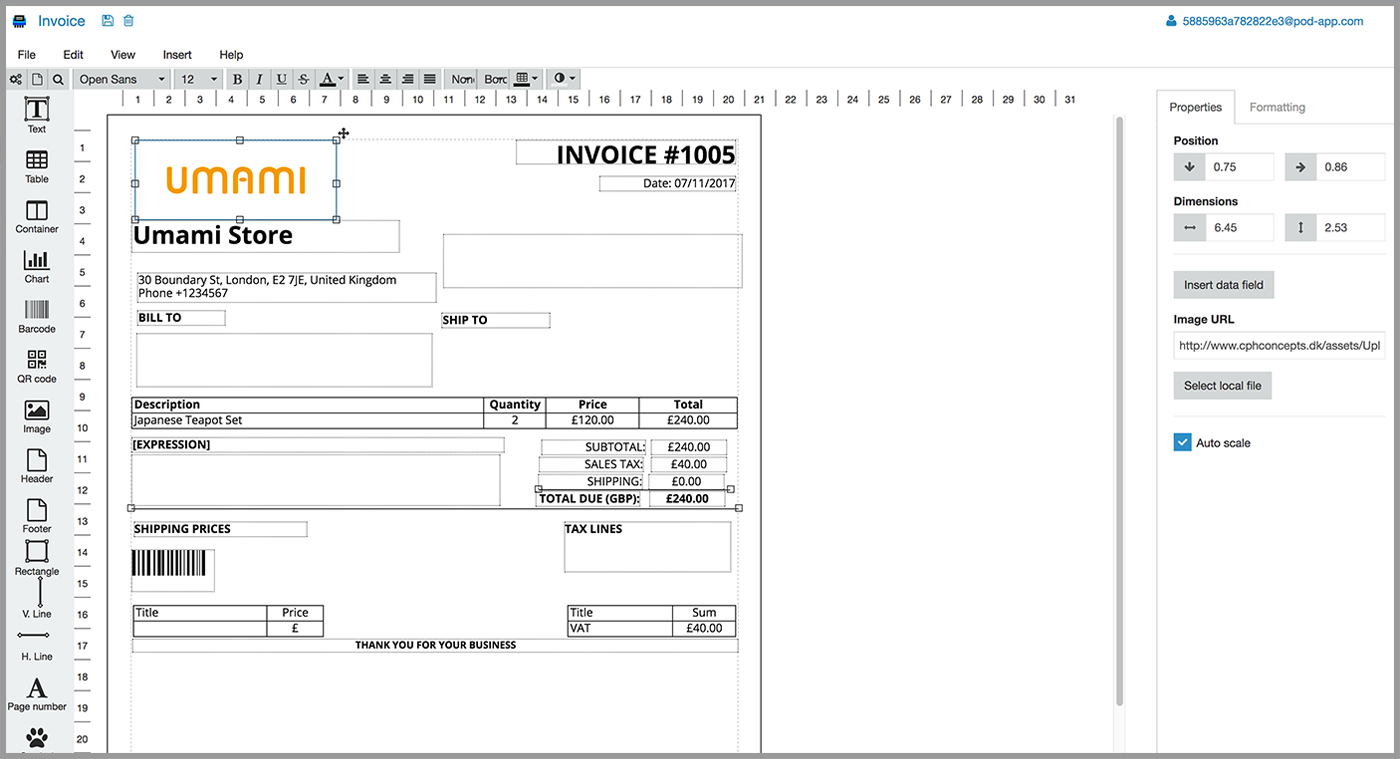

This is where you can let your branding really shine! A professional invoice usually includes your logo or banner, along with the following: Most industry professionals agree that 30 days is a standard due date, but be prepared to wait longer if it wasn’t agreed to beforehand.

Shopify invoicing pro#

Pro tip: Don’t forget to include a specified payment timeline in your contract. Perhaps one of the most important details of any invoice, you’ll want to document both the date you created the invoice (usually very close to when the work was completed), and the date the remittance is due (also called the “due date.”) You’ll want to refer to your client contract to make sure the date you mark as “due”, matches when they agreed to pay.

The reference section is also where you will include dates.

Pro tip: Use a reference system to follow, like “AAAAMMDD-Client Initial”, which helps when trying to order files in folders. You can also choose to assign one yourself. This can be done by most popular bookkeeping programs.

Shopify invoicing code#

It’s also recommended that you generate a reference number or code for every invoice you send out.

Shopify invoicing how to#

How to reference your contract and invoices together. One other bonus is the happy client more info is always appreciated by their accounting teams. This will help in the case of a legal issue down the road, and you’ll love how it keeps your own bookkeeping up-to-date. If you’ve agreed to terms that are outside the norm for your services or rates, make note of them here. Reference sectionįirst and foremost, use this portion of the invoice to call out any previous contracts, proposals, or purchase orders. You might also like: 5 Tools for Headache-Free Freelancer Invoicing. We’ve analyzed thousands of freelance invoices on Bonsai and have come up with tips to help you get paid faster, while building a healthier business. Let’s look at the basic requirements to creating an invoice that works. It cuts down on clutter, and gives you more time to create and earn (instead of hunting for lost paperwork). Piles of documentation, email chains, and phone calls can be summarized with a basic invoice. Perhaps the best benefit of a well-made invoice is the organization and freedom. If the time comes, and you have to turn over all your financial documentation, a properly done invoice will answer many questions for authorities and help prove you’re running a legitimate freelance operation. Failing to provide proper detail can leave you in the lurch with your federal taxation agency. Tax errors can be costly, especially if your invoice isn’t clear on each line item of services provided and expenses incurred. Invoices are also a lifesaving tool in the case of a rare, but panic-inducing, tax audit. Having a properly executed and easy-to-use invoicing system can greatly reduce these non-payment issues.Ī staggering 71 percent of freelancers report having difficulty getting paid at some point in their career. A staggering 71 percent of freelancers report having difficulty getting paid at some point in their career, with 81 percent of those complaints coming specifically from late payments. One essential tool that can be the key to managing your very unpredictable money situation is a professional invoice. While this is a great thing, it’s only promising if they can also find efficient and effective ways to collect on that business, and ensure a steady flow of promptly-paying customers.

Web designers, developers, and digital entrepreneurs of all kinds have almost unlimited opportunities to share their talent with a growing customer base. Freelancers face a variety of challenges, especially those in the creative fields, who may find it more difficult to value and price their work.

0 kommentar(er)

0 kommentar(er)